E-commerce has transformed the way we shop, offering unprecedented convenience and accessibility. One of the key components fueling this evolution is the payment system, which has become increasingly sophisticated and user-friendly over the years. From bulky cash transactions to the secure, seamless digital payments of today, the payment systems within e-commerce have undergone a significant transformation. In this article, we will explore the evolution of these payment systems, their impact on consumer behavior, and what we can expect for the future of e-commerce payments.

1. The Early Days of E-Commerce Payments

E-commerce began to take off in the mid-1990s with the advent of the internet and the first online retailers. However, the payment system landscape during this era was rudimentary. Most transactions were conducted using credit cards, which at the time were associated with various security and privacy concerns.

Consumers were hesitant to enter their credit card information on websites, fearing cyber fraud. As a result, early e-commerce payment systems relied heavily on email orders, which lacked efficiency. Issues such as chargebacks and fraudulent transactions plagued online merchants, causing many to shy away from e-commerce altogether. In this challenging environment, businesses and consumers alike recognized the urgent need for a robust payment solution to facilitate safe, seamless transactions.

2. The Advent of SSL Encryption and Secure Payment Gateways

As concerns regarding online security grew, technology providers started to respond. The introduction of Secure Socket Layer (SSL) encryption in the late 1990s was a pivotal moment in e-commerce. SSL created a secure channel between the website and the customer, encrypting sensitive data and ultimately boosting consumer confidence in online shopping.

Around the same time, secure payment gateways emerged, providing an intermediary between the merchant and the bank that allowed for secure processing of credit card transactions. Companies like PayPal, established in 1998, began revolutionizing online payments by providing an additional layer of security. Their platform allowed users to make payments without revealing their credit card information, which became an appealing feature for cautious consumers.

3. Mobile Payments and the Rise of E-Wallets

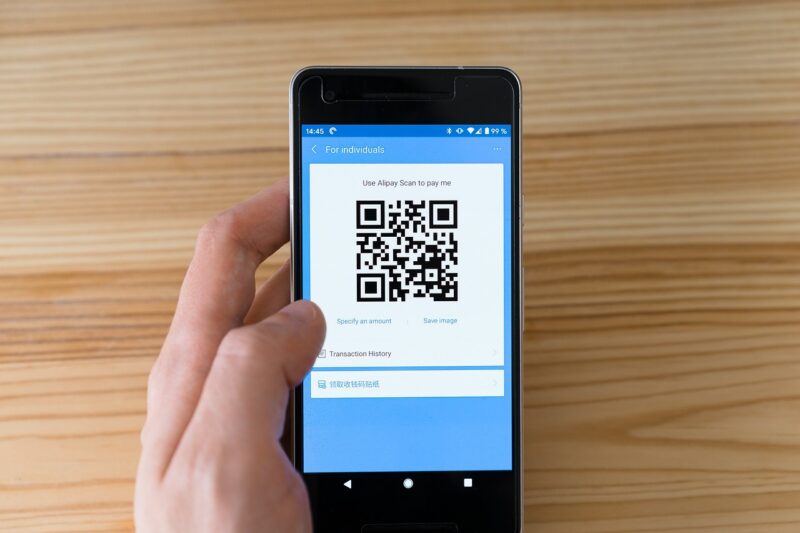

By the late 2000s, smartphones began to dominate the market, leading to significant changes in consumer purchasing behavior. With the ability to shop on-the-go, the demand for faster and more convenient payment methods soared. The introduction of e-wallets, such as Apple Pay and Google Wallet, allowed users to store multiple payment options in a single app accessible from their mobile devices.

E-wallets utilize Near Field Communication (NFC) technology to facilitate contactless payments, enabling users to make purchases with just a tap of their smartphones. This development drastically simplified the checkout process and further reinforced consumer trust in digital payments.

4. Cryptocurrency: The New Frontier in E-Commerce Payments

In recent years, cryptocurrencies such as Bitcoin have emerged as a novel payment method in the e-commerce landscape. Launched in 2009, Bitcoin offered a decentralized alternative to traditional currencies, attracting both businesses and consumers intrigued by the potential for anonymity and lower transaction fees.

Cryptocurrency payments present unique advantages, such as global accessibility, reduced chargebacks, and privacy. Several e-commerce platforms have begun integrating cryptocurrency payment options, allowing customers to transact without the involvement of banks. While this payment method is still evolving, its acceptance signals a potentially significant shift in the future of e-commerce payments.

5. The Role of Artificial Intelligence and Machine Learning

As technology continues to advance, artificial intelligence (AI) and machine learning (ML) are beginning to reshape payment systems within the e-commerce industry. These innovations can enhance fraud detection, streamline customer service, and improve overall payment experiences.

AI can analyze transaction patterns and identify anomalies, thus preventing fraudulent activities in real time. Moreover, chatbots powered by AI can assist customers during the payment process, answering queries and providing guidance, ultimately increasing conversion rates.

The synergistic application of AI and ML may lead to the development of smarter payment solutions that adapt to consumer behaviors while ensuring security and convenience.

6. Future Trends in E-Commerce Payment Systems

Looking ahead, the evolution of e-commerce payment systems is poised to continue, driven by changing consumer preferences and technological advancements. Here are some potential trends to watch:

- Biometric Payments: With enhanced security concerns, biometric payments utilizing fingerprint or facial recognition technology may become standard. This will provide users with a faster and more secure payment method, eliminating the need for passwords or PINs.

- Subscription-Based Payment Models: The increasing popularity of subscription services might lead to more businesses adopting a recurring payment model, simplifying transactions for recurring customers and enhancing customer loyalty.

- Integrated Cross-Channel Payments: As the omnichannel shopping experience grows, payment systems will need to integrate seamlessly across various platforms, ensuring customers can complete transactions whether online or offline effortlessly.

- Transparent Fees and Charges: Consumers are increasingly demanding transparency in payment processing fees. E-commerce platforms may prioritize clearer pricing structures to build trust with users.

These trends indicate that future e-commerce payment systems will be even more consumer-centric, focusing on providing a secure, adaptable, and convenient payment experience.

Conclusion

The evolution of e-commerce payment systems has significantly reshaped the online shopping experience. From the struggles of early online transactions to today’s advanced payment options, the journey underscores the importance of adaptability within the industry. As we move forward, it’s clear that successful e-commerce platforms will continue to innovate, embracing emerging technologies while placing a premium on security and customer satisfaction. The future holds exciting prospects for e-commerce payments, promising enhanced usability and a more seamless shopping experience for consumers worldwide.