10 Common Money Mistakes People Make in Their 20s and 30s

November 10, 2024

Financial literacy is a crucial skill that often goes unchecked in our education systems. When individuals enter their 20s and 30s—decades often marked by profound financial decisions—they may overlook sound financial practices that could significantly impact their futures. In this article, we will explore ten common money mistakes made by people in these pivotal years and offer insights on how to avoid them.

—

1. Neglecting to Create a Budget

Creating a budget is the foundation of sound financial management. Many young adults believe they can manage their finances without a structured plan, but this often leads to overspending. A budget provides a clear picture of income versus expenses, enabling better financial decisions.

Tips for Creating an Effective Budget:

– Track Your Spending: Use apps or spreadsheets to keep an eye on where your money goes each month.

– Set Realistic Goals: Break down your expenses into necessities and discretionary spending.

– Adjust as Needed: Review your budget regularly and make adjustments based on changing financial circumstances.

—

2. Ignoring Emergency Savings

Many in their 20s and 30s prioritize spending on experiences, often sidelining the importance of an emergency fund. This fund should ideally cover 3 to 6 months’ worth of living expenses, providing a safety net for unexpected financial challenges.

How to Build an Emergency Fund:

– Start Small: Aim to save a few hundred dollars initially, then work towards a larger goal.

– Automate Savings: Set up a direct transfer from your checking to your savings account each month.

– Reassess Regularly: As your financial situation changes, increase your savings contributions.

—

3. Accumulating High-Interest Debt

Credit cards can be an excellent tool for building credit, but they can also lead to spiraling debt if not managed properly. High-interest debt can quickly become unmanageable, particularly when lifestyle inflation kicks in.

Strategies to Manage Debt:

– Pay More Than the Minimum: Always aim to pay off the balance in full or to reduce it significantly each month.

– Understand Interest Rates: Know the rates of your debts and prioritize paying off the highest ones first.

– Consider Debt Consolidation: If you have multiple high-interest debts, look into consolidating them at a lower interest rate.

—

4. Underestimating Retirement Savings

Many young adults feel decades away from retirement, leading to a tendency to under-save. The earlier you start saving for retirement, the more time your money has to grow thanks to compound interest.

Ways to Boost Retirement Savings:

– Take Advantage of Employer Matches: If your job offers a 401(k) match, contribute enough to receive the maximum match.

– Start Early: Aim to save at least 15% of your income, increasing this percentage as you advance in your career.

– Open an IRA: If your employer doesn’t offer a retirement plan, consider opening an Individual Retirement Account (IRA).

—

5. Forgetting to Invest Wisely

While saving is essential, investing is equally important for building wealth over the long term. Many individuals refrain from investing due to fear or lack of knowledge, thus missing out on potential growth.

Investment Tips:

– Educate Yourself: Learn the basics of stocks, bonds, and mutual funds to make informed decisions.

– Diversify Your Investments: Spread your investments across different asset classes to reduce risk.

– Consider Low-Cost Index Funds: These provide diversified exposure to the market with lower fees than actively managed funds.

—

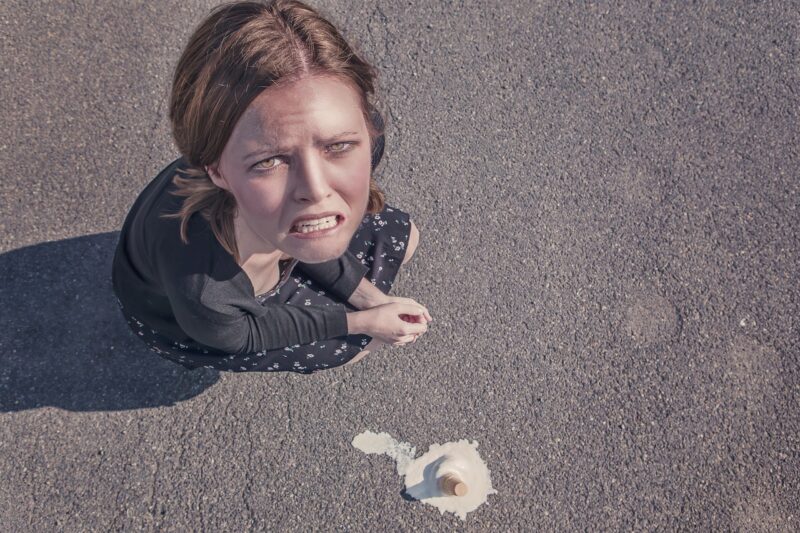

6. Living Beyond Their Means

The desire to project success can lead many young adults to live beyond their means, often using credit cards to finance a lifestyle they cannot afford. This lifestyle inflation can jeopardize long-term financial health.

Tips for Living Within Your Means:

– Evaluate Your Spending Habits: Identify needs versus wants and cut back where necessary.

– Choose Affordable Alternatives: Consider options like shared living arrangements or second-hand purchases that can save significant amounts.

– Avoid Lifestyle Creep: As your income increases, resist the temptation to increase your spending proportionally.

—

7. Not Shopping for Insurance

Insurance is a necessary expense, yet many young adults settle for the first option without exploring better deals. Failing to shop around for insurance can lead to overspending on premiums.

Finding the Right Insurance:

– Compare Providers: Use comparison websites to find competitive quotes from multiple insurers.

– Explore Discounts: Many insurance companies offer discounts for bundling policies or maintaining good driving records.

– Review Annually: Your insurance needs may change, so reviewing policies regularly can ensure optimal coverage.

—

8. Underutilizing Employee Benefits

Employees often have access to several benefits that can enhance their financial health, including health savings accounts, flexible spending accounts, and retirement plans. Many individuals overlook these valuable resources.

Maximizing Employee Benefits:

– Understand Your Benefits: Review your employee handbook to familiarize yourself with available benefits.

– Participate in Wellness Programs: Many employers offer programs that can reduce health insurance premiums or provide monetary incentives.

– Utilize Relevant Training: Employers may offer educational reimbursement programs to help pay for further education.

—

9. Failing to Keep Financial Records

Keeping track of financial documents can seem tedious, but not having organized records can lead to unnecessary stress during tax season or when applying for loans.

How to Stay Organized:

– Go Digital: Use apps or cloud storage to keep track of important financial documents and contracts.

– Set Reminders: Schedule regular check-ins to review and organize your financial paperwork.

– Keep Tax Records for 7 Years: Hold onto your tax returns and supporting documents to avoid issues with the IRS.

—

10. Ignoring Financial Education

Many young adults focus on immediate financial needs and overlook the importance of continuous learning about personal finance. A lack of knowledge can perpetuate mistakes and limit financial success.

Embrace Financial Education:

– Read Books and Articles: Numerous resources are available online and in print that can enhance financial literacy.

– Attend Workshops: Look for free or inexpensive workshops in your community or online.

– Follow Financial Experts: Consider following reputable financial blogs or social media profiles that offer sound advice.

—

Conclusion

Navigating finances in your 20s and 30s can be challenging, but avoiding these common money mistakes can set the foundation for future prosperity. By taking control of your financial situation today, you can build a stable tomorrow, allowing for more experiences, less stress, and the ability to achieve your long-term goals. Investing time in budgeting, saving, and educating yourself about personal finance will yield significant benefits that can last a lifetime.